2019 state of the fur industry.

The US mink industry is in a virtual meltdown.

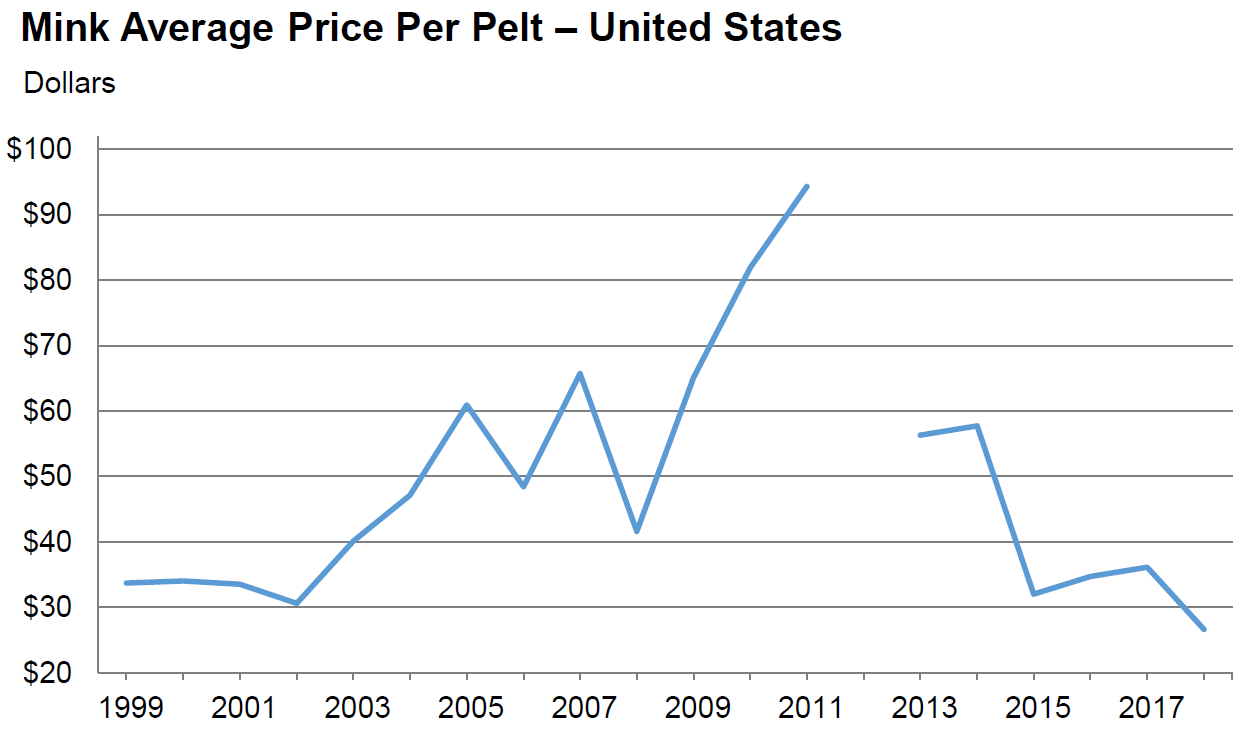

After 2013, prices went into a freefall, dropping almost 50% in a single year.

As of this writing, mink skins are selling for just around $25 – a near record low.

When you consider the average cost to raise a mink until pelting season is $35 to $42, the entire industry is in an insolvent panic, with farmers losing money each year the prices remain below their costs.

To quote a recent NAFA letter to the industry, the entire fur industry is at “unprofitable levels across all facets of the trade.”

Perhaps the only farmers who have been able to whether the storm are those who have a sizeable war chest allowing them to operate at a loss for years in a row, those with financial backers to float them through a downturn, or those who have figured out to get costs per mink below $25 (if that is even possible).

In just one year, the value of the total mink “crop” from 2017 to 2018 dropped an astounding 33%.

A few symptoms of the North American fur industry’s collapse:

- Pelt prices have been below break-even point since 2015.

- American Legend shuts down. The only fur auction house of significance in the United States shut down in 2018 and was acquired by North American Fur Auctions.

- North American Fur Auctions itself then became insolvent. Their bank severed ties, and as this goes to print, their fur industry clients are finding their checks are bouncing. NAFA is telling its clients to not attempt to cash any checks until they are are able to find a new bank.

- Unconfirmed fur industry chatter has it that “at least half if not more” of mink farms in Canada and “to a lesser extent” in the US have shut down.

What is causing this fur industry meltdown?

The biggest factor is “overproduction,” in both the US and internationally.

After the price peak of $100 per pelt in 2013, many countries ramped up their breeding. Many newer farms opened in the US and abroad, and existing US farms increased production by almost 1 million animals from 2010 to 2015. ,China alone doubled their production to nearly 40 million pelts.

And it was this overproduction that was the chief driver of the current turmoil.

Other factors include lower demand in China due to warmer winters, and economic turbulence decreasing demand in Russia.

Coalition Against Fur Farms will be watching, documenting, and celebrating the continued meltdown of the North American fur industry.

-CAFF